Tribal Enterprises Report, 2024

SCP Tribal Consultants has published its 2024 Tribal Enterprises Report, which tracks tribal enterprises, investments, and programs in U.S. Indian Country. Our tribal enterprise tracking supports our work with tribal nations for economic development and specific project planning and implementation. Over the past decade, the global changes to supply chain, national energy imperatives, and reshoring of key industries, has created a myriad of new opportunities for economic development among U.S. tribal nations.

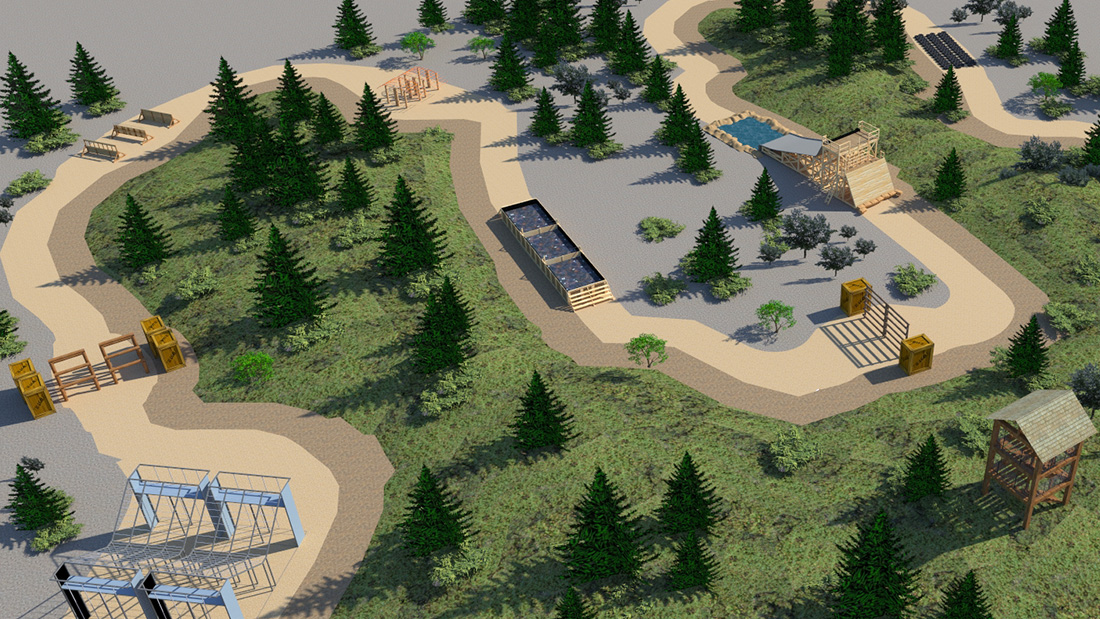

Tribal enterprises tracked in our report range from tribal casinos and c-store / truck stop travel centers, adventure recreation, and other hospitality properties, to commercial businesses, construction companies, and Tribal SBA 8(a) investments. Tribal investments beyond casinos and c-stores (and truck stops) include destination golf courses, agricultural operations, cannabis growing and retail facilities, and many other asset classes. Tribal Enterprises also include facilities and programs operated for community benefit including health care venues, tribal housing, senior housing, and industrial real estate.

A digital version of our 2024 Tribal Enterprises Report is available upon request through our Contact form. Some tracking lists from the annual report an be viewed on the Research page of this website.

Our research unit also maintains a database of U.S. government grant and other funding programs for Indian County, applicable to tribes and tribal enterprises. We have started to post updates to these grant programs to this website as we become aware of changes or new opportunities.

Our Tribal Enterprises Report limits its tracked enterprises and investments to those disclosed by tribes and pueblos in their websites, local news reports, and 3rd-party websites and media, as well as our own field visits. We also review Indian Country-focused websites maintained by the Department of Interior and other government agencies.

SCP Tribal Consultants is part of StoneCreek Partners LLC and affiliated with Adventure Entertainment, first established in 1984.